Article

A Balancing Act: How Can Utilities Bridge Affordability and Sustainability?

Stacey Kinley, Marie D’Arrigo, Efram Lebovits, Andrei Flueraru, Erika Siegert — February 12, 2025

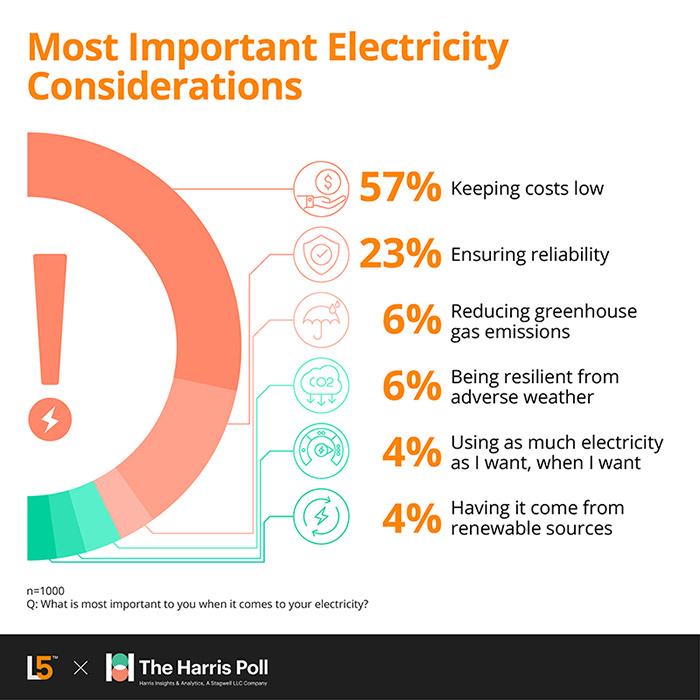

Societal pressure is mounting for utilities to juggle two seemingly opposing forces: affordability and sustainability. While public interest in sustainability has been a focus in recent years, affordability almost always takes precedence for consumers when economic tides turn. Recent research conducted by Level5 Strategy and The Harris Poll Canada finds that ‘keeping electricity costs low’ is currently the top priority for 57% of Canadians.

Many consumers may have a strong desire for environmental progress but often do not want to inherit the cost that comes with it. Consider the adoption of sustainable solutions, where only 1 in 5 have invested in small-scale energy efficient technologies, such as smart thermostats (20%). This drops to less than 1 in 10 for larger purchases, such as electric vehicles (6%), or solar panels (4%). Our data suggests that consumers would be far from happy paying for costs associated with sustainability investments – especially from government-funded organizations.

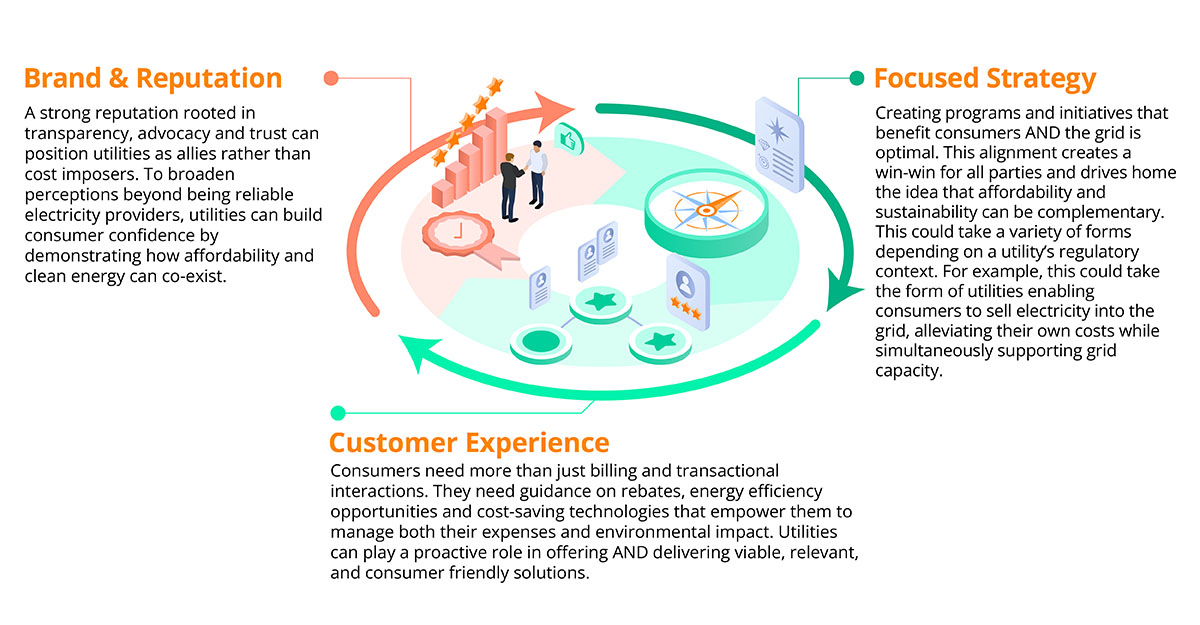

So, how can utilities navigate the balance of sustainability and affordability? Now more than ever, they have an opportunity to proactively bridge the gap. By playing a dual role—as educators and innovators—utilities can position themselves as leaders and allies in the push for affordable AND sustainable energy solutions.

Affordability is the undisputed priority for customers, overtaking environmental concerns as individuals grapple with financial constraints.

Only 6% of people believe reducing greenhouse gas emissions is the most important issue in electricity, and nearly half (47%) oppose federal electric vehicle mandates. Instead, the focus has shifted to reducing household costs. A staggering 88% worry about increased electricity rates, 79% about electric vehicle purchase costs, and 72% about the expense of recharging compared to refueling.

As consumer sentiment can inform public policy, utilities face a unique opportunity to position themselves as part of the solution to both affordability and sustainability by getting ahead of evolving market dynamics and growing consumer choice. With utilities sitting between the grid and the population, they are uniquely positioned to not only play a role in managing costs, but to purposefully serve as a trusted advisor for consumers.

Proactive utilities can cultivate more meaningful consumer relationships.

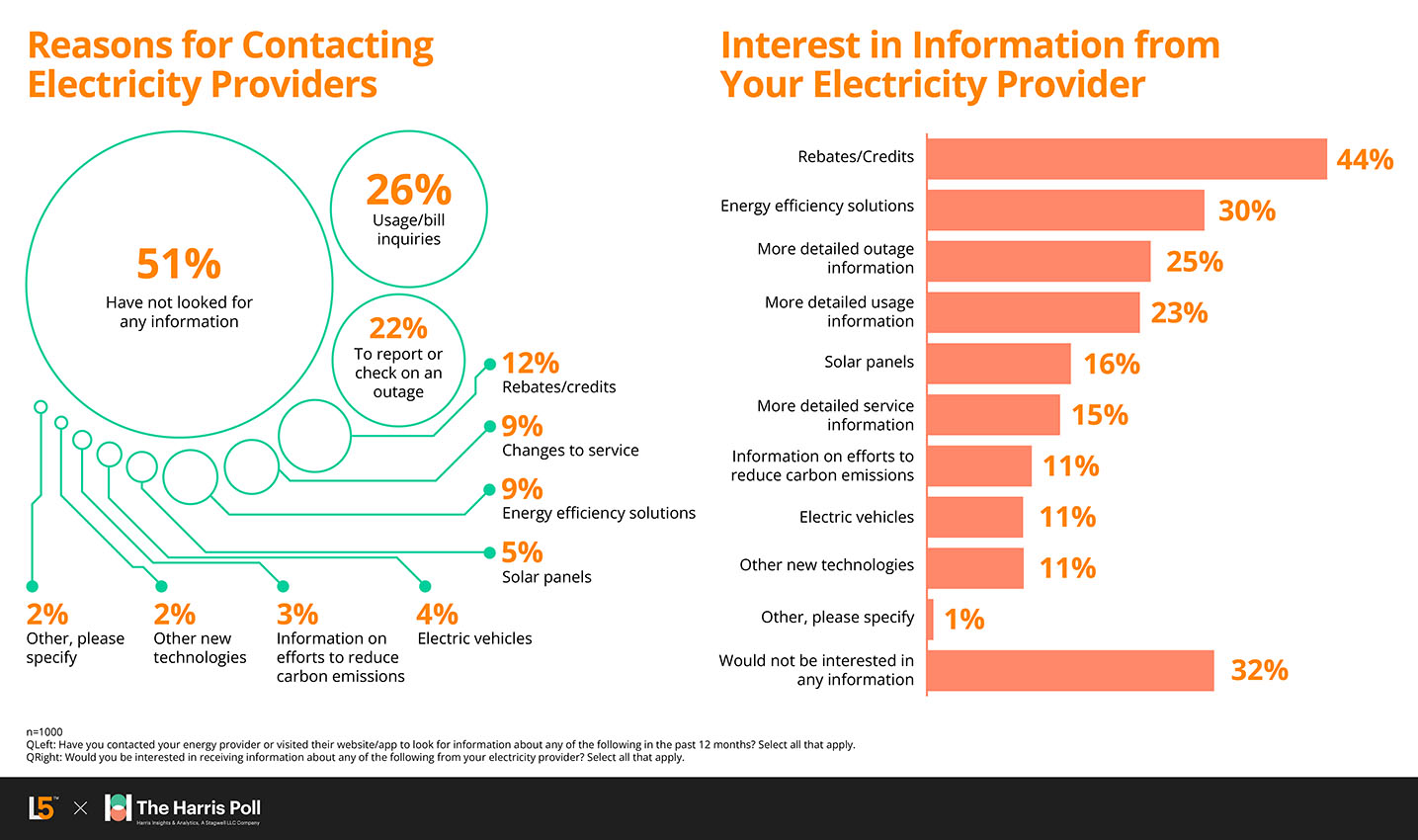

Despite a growing narrative around adopting new technologies, most consumers are not actively seeking information from their electricity providers. Only 5% of consumers have sought details on solar panels, 4% on electric vehicles, and 2% on other innovative technologies.

While most interactions with utilities remain transactional, with 26% focused on billing inquiries, and 22% on outages, consumers want more information, especially when it comes to saving money or having more control over their bills. 70% express a desire for insights from their providers with a particular focus on rebate opportunities (44%) and energy efficiency solutions (30%).

Utilities have an opportunity to redefine their role – not just as service providers, but as trusted partners in energy affordability and sustainability.

The balance between affordability and sustainability is a delicate one but has immense opportunity for impact.

Utilities can shape a future where sustainability and affordability go hand in hand—building strong brand credibility, reputation, and consumer connections to the benefit of the environment and the bottom-line.

This survey was conducted online from November 5th to 11th, 2024, among 1,000 Canadian adults ages 18 and older. The sample was weighted to age, gender, and region Canadian census data.