Article

Executive Perspectives on the Future of the Canadian Mutual Insurance Industry

Laura Richard, Joseph Smith — October 20, 2025

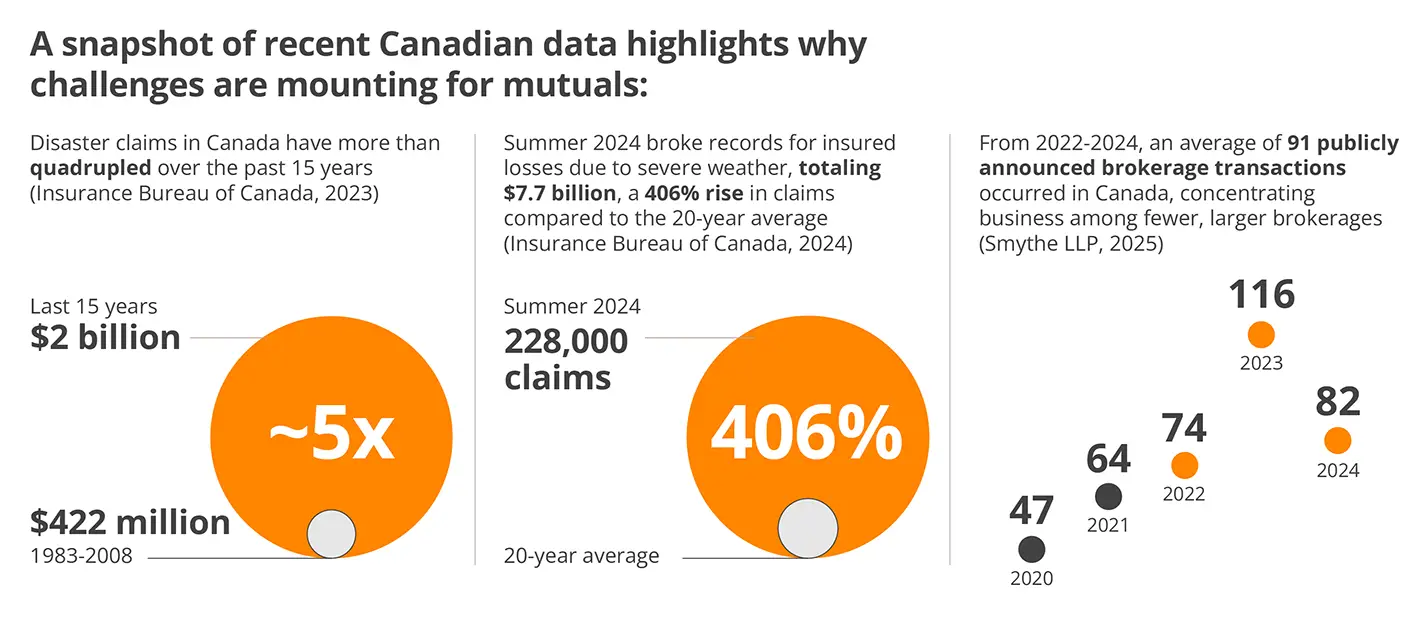

Long defined by community roots and policyholder ownership, mutuals now confront a convergence of pressures that threatens their traditional model: catastrophic weather claims that reached a record-breaking $7.7 billion in 2024, rapid broker consolidation that’s reshaping power dynamics in the distribution model, increasingly digital-native consumers who expect better digital experiences, and demographic turnover that’s shifting the needs and expectations of both customers and employees.

Unlike previous decades when longstanding broker relationships and community engagement were sufficient competitive moats, mutuals must now answer a more existential question: what does the future of the mutual industry look like in a world where scale, technology, climate change, and consumer expectations are changing so rapidly?

To explore this, Level5 interviewed executives across Canada’s mutual insurance sector – from CEOs of century-old farm mutuals that have expanded nationally to leaders of regional organizations managing hundreds of millions in premiums. Their perspectives, while diverse, had several common themes.

Theme 1 – The Scale Imperative: Is Amalgamation the Only Path Forward?

Amalgamation is quickly becoming a pressing agenda item at Board meetings in the Canadian mutual sector. This is being driven by a growing range of concerns impacting mutual insurers’ ability to remain competitive in the industry such as investment in modern technology platforms, maintaining relevance to an increasingly consolidated broker network, burdensome regulatory requirements, and protection against the volatility of climate-driven catastrophe risks.

The dramatic rise in losses coupled with broker consolidation suggests remaining small is fraught with challenges. While there were varied perspectives among the executives interviewed as to the minimum scale a mutual will need to reach to remain viable and resilient over the next 10-20 years, the consensus is that growth and scale is a strategic imperative. This threshold reflects practical realities as there is a minimum scale required to invest in modern technology, attract quality talent, and maintain financial resilience against increasing volatility.

Although amalgamation is a viable path to achieving scale, it is not the only option. Two other viable pathways are shared infrastructure and strategic alliances. Through shared infrastructure, mutuals can jointly invest in technology platforms such as policy administration systems, data analytics tools, or digital broker portals. This allows each participating insurer to benefit from enterprise-grade capabilities while spreading the financial and operational burden. For example, some Ontario mutuals have adopted the same core systems (like Guidewire or Cognition+) through shared-service arrangements, achieving consistency and efficiency without merging. Strategic alliances represent a second route. Mutuals can collaborate in underwriting pools, distribution partnerships, or joint product development to access new markets and share risk. These will be further explored in the second section of this article.

Theme 2 – Identity Preservation While Modernizing: The Both/And Mindset

Mutuals face a profound strategic identity challenge that extends beyond operational efficiency: how to modernize and scale while retaining the community-driven ethos at the core of their existence. This tension manifests in boardroom debates, strategic planning sessions, and daily operational decisions across the sector.

Executives consistently warn against two destructive extremes. The first is organizational nostalgia: clinging too tightly to community roots, legacy processes, or governance structures that no longer serve current market needs. The second is identity dilution from pursuing modernization so aggressively that mutuals become indistinguishable from stock insurers, thereby eliminating their competitive differentiation and stakeholder value proposition.

The strategic opportunity lies in dismissing this as a false dichotomy. As one CEO of a provincially regulated mutual noted “mutuals should endeavour to adopt what organizational theorists call a “both/and” mindset rather than “either/or” thinking”. Mutuals should seek to discover how to adapt and grow creatively without sacrificing the foundational values that differentiate their model. This approach requires sophisticated strategic thinking that preserves the organization’s core identity while enabling modernization and scale.

The sector’s historical progressiveness provides both an inspiration and a template to consider. Mutuals were originally created to address unmet market needs by providing insurance to farmers and rural communities that stock companies deemed unprofitable or too risky. That pioneering spirit and willingness to innovate for underserved customers must be recaptured. Modern mutuals are beginning to identify new segments such as small businesses seeking personalized service, communities requiring specialized risk management, or customers demanding sustainable insurance practices that align with environmental values. Large stock insurers often focus on the biggest, easiest-to-reach segments, leaving mutuals with a compelling opportunity to differentiate by becoming expert players in specific niches.

Theme 3 – Closing the Consumer Relevance Gap

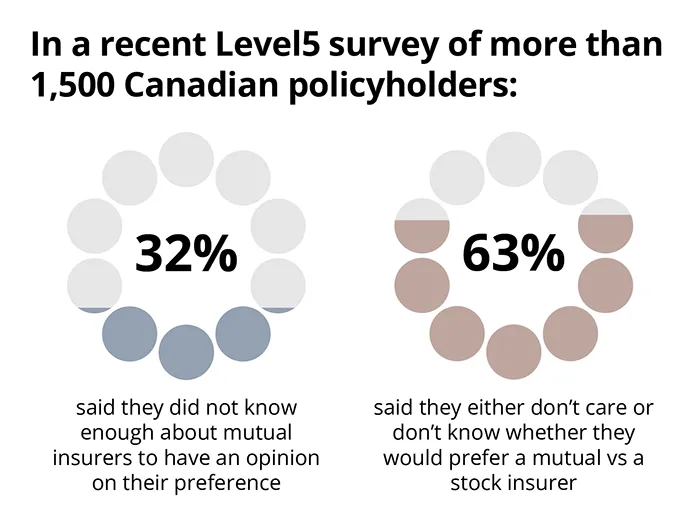

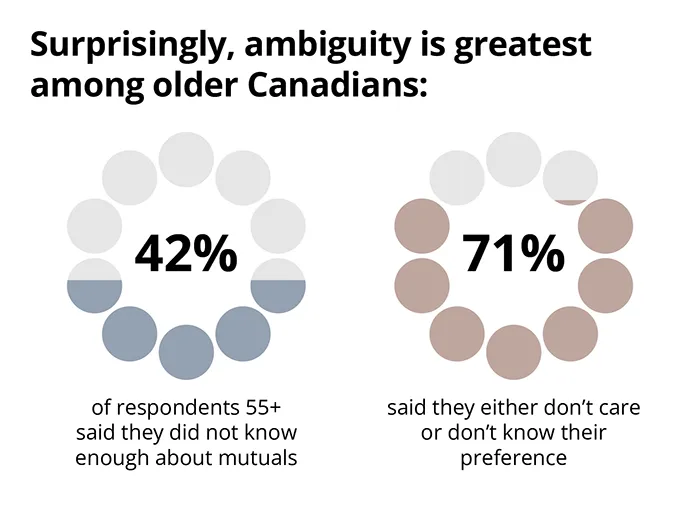

A recurring theme across executive interviews and primary policyholder research reveals a disconnect that Level5 believes must be addressed for mutuals to become relevant to a new generation of consumers: policyholders often do not understand nor actively value the mutual model. This consumer gap represents both a strategic challenge and a competitive opportunity.

Without a clearly understood and appreciated value proposition, mutuals will risk losing market share to stock insurers, which often price lower, bind faster, and innovate more in policy design. However, these data may also be interpreted as indicating an opportunity among younger consumers who tend to care more about sustainability and community engagement. Thus, mutuals may be able to engage younger consumers through targeted communications and deliberate brand building catering to the needs of these customer segments.

Adding to the challenge of maintaining consumer relevance is that many customers perceive their broker to be their primary insurance relationship, viewing the insurer as a distant, interchangeable provider. As one executive noted “most consumers probably think their broker is the actual insurance provider”. Moreover, insurance remains what economists call a “grudge purchase”, a necessary expense that generates little enthusiasm or engagement.

The strategic response to this challenge cannot rely on the traditional approach of marketing the purported benefits of choosing a mutual insurer while delivering the same customer experience as a stock carrier. Instead, the path forward lies in demonstrating mutuality through tangible, differentiated experiences that create genuine value. This means excellence in claims handling that exceeds customer expectations, proactive risk management services that prevent losses before they occur, and meaningful community impact that builds emotional connection and local loyalty.

A parallel example is the credit union industry, which has endeavored to demonstrate the value of credit union membership. In addition to lower fees, personalized service, and reinvesting profits in local communities, credit unions have created products that embed mutuality into their design. Examples include Affordable Housing GICs and Loans, which fund long-term affordable housing projects, and Crisis Care GICs and Loans, which support members in times of financial hardship.

Some mutuals are working to live their promise in new ways by launching initiatives designed to help customers reduce risk. Examples include offering loss prevention services and “build back better” provisions that help homeowners reduce the risk of future losses; returning surplus earnings back to policyholders in transparent and meaningful ways; and investing in community resilience projects that demonstrate cooperative values. Examples include Co-operators’ “TomorrowStrong” endorsement, which reimburses clients to rebuild with resilience after a loss, and Wawanesa’s $2 million annual community impact program to support climate resilience efforts across Canada. These initiatives transform mutuality from abstract concept to concrete benefit, making the cooperative model relevant to contemporary consumers who increasingly value corporate purpose and community engagement.

Theme 4 – Technology: From Vulnerability to Competitive Advantage

Technology represents perhaps the sector’s greatest paradox – simultaneously the most significant vulnerability and the most promising opportunity for future competitiveness. The executives interviewed agreed that mutual companies historically lagged in technology adoption, with implementations described as excessively costly and fragmented and system integration as persistently challenging.

The aforementioned lack of scale of many mutuals often exacerbates these challenges. Individual mutuals struggle to justify major technology investments across limited premium bases. Even when systems are successfully deployed, they often lack integration with existing processes, creating operational inefficiency rather than competitive advantage. Legacy systems built for simpler times now constrain rather than enable business growth.

However, forward-thinking mutuals are discovering that collaborative approaches can transform technology from liability to competitive advantage. Shared infrastructure initiatives allow multiple mutuals to pool resources and achieve economies of scale previously available only to large stock companies. Industry-wide platforms can provide sophisticated capabilities such as advanced analytics, digital customer interfaces, and automated underwriting at accessible cost points.

As with all industries, it will be important for mutuals to keep pace in AI. By 2025, it is estimated that 84% of global insurers will have begun to adopt, or plan to deploy AI solutions. AI has the potential to improve the efficiency of underwriting, automate time-consuming manual processes, and improve personalization of communications and experiences. In a recent survey conducted by Intelligent Insurer, 65% of underwriters see AI as the top opportunity to boost underwriting profitability. AI also enables dynamic pricing, with real-time risk assessments that shorten rate-to-market times and improve price competitiveness. Beyond underwriting, AI can also automate manual work such as document processing, freeing time for higher-value tasks and reducing human error. Although the potential benefits of AI are substantial, the costs to deploy effectively and safely can be high. AI must be deployed deliberately and mindfully with the appropriate planning, governance and training to mitigate the risks that can arise from improper implementation and use. Mutuals would benefit from developing a technology and AI strategy within their multi-year strategic plan to ensure that implementation is budgeted for, resourced, and rolled out effectively.

The technology imperative extends beyond legacy system replacement to fundamental business model innovation. Technology enables new forms of customer engagement, data-driven risk assessment, and operational efficiency that can restore competitive positioning against larger, better-resourced competitors.

Theme 5 – The Talent Transformation Challenge

The sector’s talent challenge impacts at multiple levels, each requiring distinct strategic responses. Insurance has traditionally struggled to attract young professionals who view the industry as static, bureaucratic, or disconnected from contemporary career aspirations. This perception problem has intensified as technology and financial services sectors offer more compelling value propositions to emerging talent.

The demographic transition compounds this challenge. Experienced professionals who possess deep industry knowledge and institutional memory are retiring in significant numbers. Their departure creates both immediate operational challenges and long-term knowledge transfer issues. Simultaneously, younger employees enter the workforce with different expectations about workplace culture, professional development, and purpose-driven work.

Remote and hybrid work arrangements, accelerated by pandemic experiences, have complicated traditional training and onboarding approaches that relied heavily on apprenticeship models and informal knowledge transfer. New employees require different development approaches, and organizations must adapt their culture and processes accordingly.

Successful mutuals are responding with comprehensive talent strategies that extend beyond compensation to encompass purpose, growth opportunities, and modern workplace cultures. They’re building talent pipelines through partnerships with educational institutions, internship programs, and community engagement initiatives. Additionally, they are modernizing workplace cultures to attract and retain younger employees while preserving the collaborative, community-oriented values that differentiate mutual organizations.

Investment in people represents an operational and strategic necessity. Mutuals that successfully attract, develop, and retain talent will possess sustainable competitive advantages that technology alone cannot provide.

How Might Mutuals Overcome These Challenges?

The Canadian mutual insurance industry’s future will be determined by its ability to thoughtfully and courageously respond to the mounting external pressures it faces. Climate change, technological disruption, shifts in consumer and demographic expectations, and shifting industry dynamics will dramatically impact the insurance landscape in the near future. The executives interviewed for this analysis demonstrate that the sector possesses both the strategic insight and operational capabilities required for successful transformation. It is the courage to act that will determine who thrives amidst these coming changes.

Level5 has identified four strategic responses mutual insurers can consider to remain competitive: Specialize, Collaborate, Consolidate, Innovate.

Specialize

Canadian mutuals have an opportunity to win by focusing on niches underserved by larger carriers. Farmers, niche and emerging business segments, and multi-generational households are examples where specialized products can meet needs that are often overlooked. For instance, Sandbox Mutual Insurance embarked on a transformation that combined digital modernization, an identity rebrand, and customer experience enhancements to complement its core and specialized product offering and improve its relevance to the markets it serves.

Another example is Trillium Mutual Insurance, which has sustained its relevance by focusing on farm segments and rural communities where national carriers have limited appetite. By deeply understanding local conditions and tailoring products accordingly, Canadian mutuals can differentiate not by scale, but by delivering specialized expertise and service in markets that larger insurers often treat as peripheral.

Historically, Wawanesa began as a small Prairie mutual in 1896 and grew into a national insurer by first specializing in agricultural coverage before expanding into urban and commercial markets. These examples show that mutuals can compete by building deep expertise and service in niches that larger insurers often treat as peripheral.

Collaborate

While mutuals have long operated independently, the pressures of scale, cost, and technology may now demand creative collaborative solutions. By pooling resources, mutuals can achieve capabilities that would be unattainable alone. Farm Mutual Re provides a proven example: as a collectively owned reinsurer, it spreads catastrophic risk across the sector and gives even the smallest mutuals access to capacity they could not secure individually.

The same idea can be applied to technology. Enterprise-grade platforms such as Guidewire or SAP are prohibitively expensive for individual small or mid-sized insurers, but if implemented through a shared-services model, mutuals could lower costs, standardize broker interfaces, and deliver consistent consumer experiences. Beyond technology, opportunities include collaborating on joint recruitment programs to address sector-wide talent shortages, common training academies for underwriters and claims staff, and shared marketing campaigns to strengthen awareness of the mutual difference.

Together, these forms of collaboration will allow mutuals to retain their independence while accessing the scale, infrastructure, and visibility required to compete with national carriers.

Consolidate

Some mutual executives advocate outright amalgamation to achieve scale rapidly, pointing to successful examples where merged entities have achieved stronger market positions and operational efficiency. Others question whether the efficiencies touted as merger benefits actually come to fruition and instead champion more nuanced approaches. Despite the differences in how to achieve scale, executives consistently note that its benefits provide the capacity to strengthen negotiating power with brokers, enable investment in technology, and provide protection against climate-driven catastrophe risk. Some companies are already demonstrating how consolidation can work effectively in practice. The Commonwell Mutual Insurance Group was created in 2014 through the amalgamation of three Ontario mutuals (Farmers’ Mutual Lindsay, Glengarry Mutual, and Lanark Mutual), giving the combined entity both greater geographic reach and financial resilience. Similarly, Economical Insurance, while no longer a mutual, illustrates the transformative power of consolidation. While it demutualized in the process, it was able to leverage its shift in structure to build scale and invest in advanced digital capabilities and customer experiences.

Innovate

Innovation is perhaps the most difficult, yet important, opportunity for Canadian mutuals. The sector faces high technology costs, cultural risk aversion, and regulatory guardrails that make experimentation difficult. Yet successful precedents show that innovation can occur when acted upon boldly and structured deliberately. First Acre Insurance, created as a standalone MGA backed by Red River and The Commonwell, demonstrates how separating new ventures from legacy operations allows for bold experimentation. By focusing on farm-specific pain points such as real-time asset valuations and geocached site mapping First Acre Insurance has delivered tools that national carriers have not matched while insulating its parent mutuals from excess risk.

Other mutuals are showing innovation through different channels. Trillium Mutual has invested heavily in risk-prevention services, using data-driven loss-prevention programs to reduce claims in rural communities and offering tailored tools for policyholders to actively manage farm and property risks. Red River Mutual has leaned into a purpose-driven innovation strategy, branding itself as “insurance that protects communities” and backing this up with initiatives like the Spruce Up Your Story community renewal program, which funds local revitalization projects and builds stronger ties with policyholders. These examples represent cultural and strategic shifts in how mutuals can innovate to create value.

Looking ahead, mutuals can adopt a “two-speed” model: keeping their core focused on underwriting stability while incubating new products, partnerships, and digital solutions in separate entities or shared labs. Investment in AI-enabled claims handling, predictive underwriting for climate risk, and innovative, niche-specific insurance products are natural next steps. By reframing innovation as a necessity, Canadian mutuals can ensure their relevance in a market increasingly shaped by digital-first competitors.

The Path Forward

The path forward demands integrated thinking that embraces all four imperatives simultaneously. Identity preservation through innovative interpretation of mutual values. Consumer relevance through demonstrated value rather than stated principles. Technology advancement through shared infrastructure and strategic innovation. Talent development through comprehensive cultural and operational modernization. Leveraging scale gained through consolidation, collaboration or cooperation to build resilience in the face of climate change, gain bargaining power in an increasingly consolidated industry, and invest in technology and human capital.

The mutual model’s fundamental promise that cooperative ownership creates better outcomes for members and communities remains as relevant today as when these organizations were founded. The challenge is not whether this promise still matters, but whether mutuals can realize its value while navigating the challenges facing the industry in the coming years. Mutuals that successfully navigate this transformation will emerge stronger, more relevant, and better positioned to serve their communities in the coming years and will go on to shape the future of mutual insurance in Canada.

Contributors

- Cara Cameron – Portage Mutual Insurance

- Enrico Mastrangeli – The Commonwell Mutual Insurance

- Jennifer Ewankiw – Red River Mutual

- Ken Worsley – Nova Mutual

- Robin Shufelt – First Acre Insurance

- Sue Perreaux – SGI Canada

- Tim Shauf – The Commonwell Mutual Insurance

- Tracy MacDonald – Trillium Mutual Insurance

Sources:

Level5 Mutual Insurance Consumer Research Survey, August 2025

Insured Damages from Hurricane Fiona Now Over $800 Million

M&A Frenzy Continues: Canadian Insurance Brokerage Industry Update

CO-OPERATORS REINFORCES ITS COMMITMENT TO COMMUNITY RESILIENCE WITH NEW PROPERTY INSURANCE COVERAGE

AI in Insurance Claims Statistics 2025: Top Trends and Data