Level5 Strategy was founded on the conviction that your company’s brand is your most valuable asset. The immediate next question becomes: just how valuable is that brand?

It has proven to be challenging for brand managers and strategists to respond to this question and to quantifiably prove the value of their brand. Level5’s brand valuation exercise does just that.

Before we discuss methodology, let us briefly go back in time to understand why it is now so important to uncover the value of your brand.

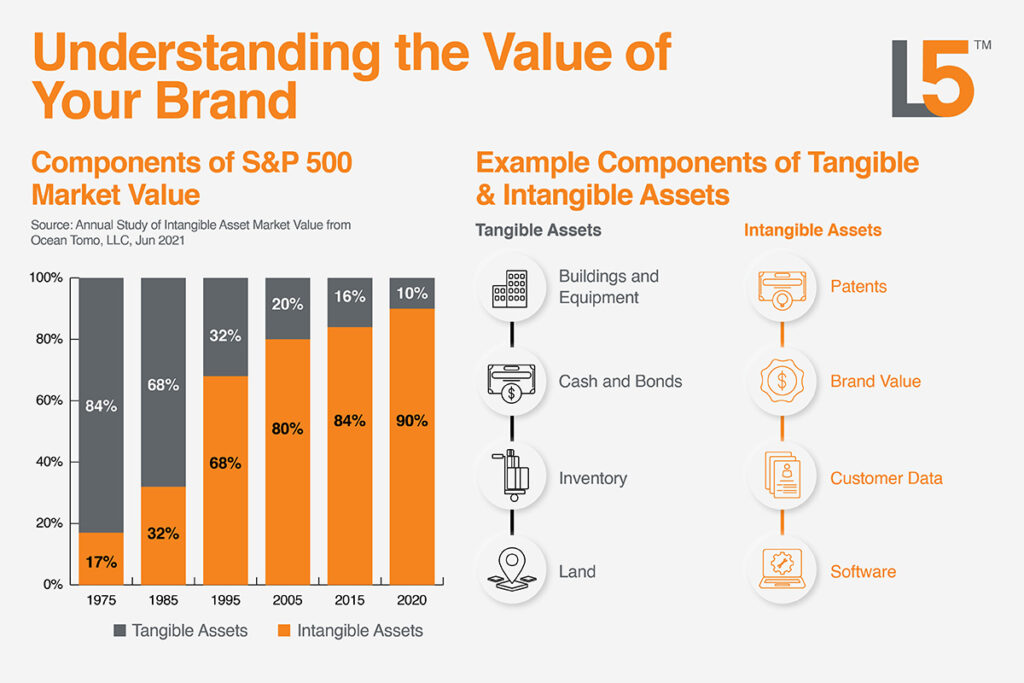

The countries we now think of as highly developed – England, the U.S., and Canada, for example – built a foundation of economic success through the Industrial Revolution in the late 19th century. Economic growth was back then channeled through what are referred to as ‘tangible assets’: machinery, factories, and raw materials, for example. In 1975, these tangible assets comprised 83% of the value of S&P 500 companies.

However, since the 1980s, highly developed countries have experienced rapid de-industrialization – meaning their overall industrial capacity and output have declined. In place of industrial output, economic growth has been increasingly driven by intangible assets like intellectual property, technological knowledge, customer data, and of course – brands. Today, the value equation has flipped – only 10% of market value is a function of the tangible assets we discussed above. In contrast, 90% of S&P 500 market value now lies in intangible assets – just think of the Facebooks and Netflixes of the world and it is easy to understand why this has happened.

As this shift occurs, a problem has arisen. Due to their immateriality, it is difficult to measure the real value of this new class of assets. Organizations are left unclear about the value of their intangible assets (like brands), despite them being of utmost importance for business success.

As a professional in this space, do you struggle with this problem? Do you get questions about the material value of something intangible like your brand? Do your finance-driven executives struggle with the concept?

What is Brand Valuation and what benefits does it provide?

Brand valuation is the process of determining the monetary value of a brand. It involves analyzing and measuring the various components that contribute to building and maintaining a strong brand and can be calculated by exploring total costs, market value, or future economic value.

Valuing your brand creates benefits across business functions. For example:

- Concreteness: By translating one of your organization’s most valuable assets into concrete terms understood by financially minded executives, the notion of investing in a brand becomes more compelling and justifiable.

- Organizational Alignment: Level5’s business model is centred on the conviction that your brand is the sum of your entire business system. In a brand valuation, this belief is translated into a financial value and unique to Level5’s approach is the definition of what uniquely drives the value of a brand in its industry. From there, investing in growing and strengthening the brand becomes more clearly understood, more compelling and more actionable for teams across functional areas.

- Tracking: Brand value can be tracked over time to assess yearly performance and make necessary strategic adjustments.

- Brand Strategy: Having assessed the drivers of your brand value, you will have a common fact base from which to build the right strategy. Level5 has a proven track record of helping organizations align to compelling, differentiated, and actionable brand strategies, and the brand valuation exercise can be used to inform this work.

Brand valuation methods tend to fall into three categories: cost-based, market-based, and income-based approaches. In each of these categories, a different set of inputs are used to define the value of a brand:

- Cost-based approach: This method considers the total costs involved with the development and maintenance of a brand – including expenses like marketing spend, research, and salaries – to evaluate the total value of the brand. The approach is straightforward and easy to calculate, but it ignores intangible components such as loyalty, reputation, and intellectual property that all contribute to a brand’s value but might not be accurately represented by the costs associated with its upkeep.

- Market-based approach: This method values a brand by analyzing the market value of comparable brands. This approach relies on an assessment of market transactions, like mergers and acquisitions. While this method reflects market reality, the availability and quality of comparable transactions are often limited, making it difficult to find suitable benchmarks. These transactions are also heavily impacted by market conditions and trends, which leads to the potential for over or undervaluation.

- Income-Based Approach: The income-based approach estimates the value of a brand based on the future economic value it generates. This approach is helpful because it is forward-looking and focused on value creation, which provides a more comprehensive and actionable valuation than cost or market-based methods. It is also flexible and adaptable to various industries, market conditions, and business models.

At Level5, we recommend a widely accepted income-based approach called the royalty-relief method.

The royalty-relief method estimates the value of a brand by calculating the net present value of the income that can be attributed to the brand. This is done using publicly available royalty rates – fees paid to the owner of intellectual property by someone who wants to use that property in their own products. For example, a Subway franchisee pays a royalty fee to Subway for their use of the Subway brand. The net present value of those royalty fees is a close approximation to the value of the brand.

In our valuation process, Level5 leverages royalty rates from the client’s sector as a benchmark for the valuation. From this starting point, we compose a bespoke royalty rate for our client based on a brand value scorecard, which is comprised of a comprehensive data set across key metrics (i.e., consumer awareness, perceptions, loyalty, etc.). The brand health scorecard results provide an adjustment to the royalty rate and assurance that the respective strengths and weaknesses of the brand are factored into its financial valuation.

We’ve always believed our brand was our most valuable asset, but until it was quantified, we never really knew. With our recent Level5 brand valuation initiative, we’re better prepared for the future. It has enabled us to more clearly identify and communicate the drivers of our brand’s value – so we can better understand its strengths and weaknesses – plus assess its performance relative to our competition. Most importantly, we now have a model that we can update and track as we invest to strengthen our brand further over time.

– Managing Director, Leading Canadian Insurance Provider

In today’s economy increasingly driven by intangible assets, understanding the value of your brand is essential for sustained business success. Do your organization’s executives have an understanding and appreciation of the value of your brand? Brand valuation equips your organization with the knowledge to invest in and leverage your most valuable asset and bridges the gap between perception and tangible impacts to make informed strategic decisions.

Interested in valuing your brand? Reach out to Laura Richard or Jonah Zgraggen.