What exactly is Fintech and how can it be changing our daily lives, not just banking?

Fintech is, simply put, technology used for financial transactions, such as online banking or mobile banking. Where Canadian banks stop, Fintech in other countries has evolved to Finlife

What exactly is Fintech and how can it be changing our daily lives, not just banking? Fintech is, simply put, technology used for financial transactions, such as online banking or mobile banking. Where Canadian banks stop, Fintech in other countries has evolved to Finlife.

In June 2018, Ant Financial Services Group – operator of China’s biggest online payment platform – raised around $14 billion in what market watchers called the biggest-ever single fundraising effort to be undertaken globally by a private company.

Ant Financial, currently worth 50% more than Goldman Sachs, is poised to become one of the most valuable Fintech companies in the world. What surprises me is that the company didn’t start out as a traditional bank, accumulating its assets by attracting deposits. Rather, it was initially created to serve as a payment solution provider when its parent company Chinese technology giant Alibaba started out as an online shopping platform.

In China, money primarily flows through a pair of digital ecosystems that blend social media, commerce and banking. These ecosystems are run mostly by Alibaba and another Chinese tech giant called Tencent. While neither company started out as a bank, both have surpassed Chinese banks in terms of fee-based revenues, in particular, revenues from payments.

If we put this into a global context, while many traditional banks are struggling to increase their fee-based revenues in this low-interest rate environment, two forerunners have already emerged in China.

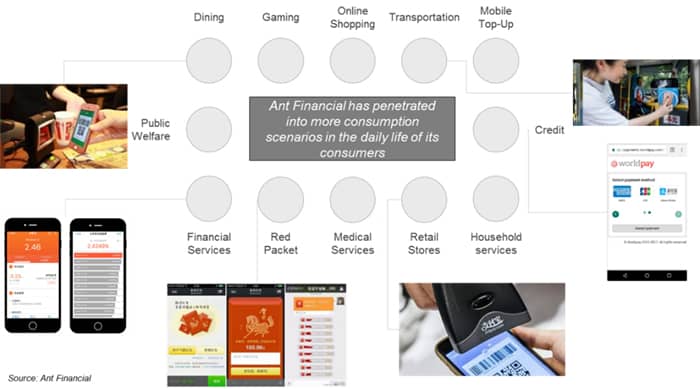

Furthermore, driven by leading Chinese online financial institutions, the Chinese financial service industry is evolving to adopt a scenario-based financial service model based on the concept of ‘Finlife’ – a term originally coined by Long Chen and later echoed by Cheng Li, the CTO of Alipay.

China has put ‘Finlife’ on the map. Should Canada follow their lead?

It appears we’d be wise to do so.

According to Chen, ‘Fintechs’ have been able to grow much faster in China compared to the rest of the world because there has been a concentrated effort to develop financial services that aim to make ‘real life’ better, rather than strictly digitizing existing financial services, as the chart below illustrates.

By following China’s trend-setting lead, Canadian banks will find themselves well positioned to:

1. Leverage leading practices from other countries to develop unique competitive advantages in their home markets

Banking is a highly competitive yet saturated industry in North America. At least in Canada, all five major banks offer similar products and services. It is hard for a bank to differentiate itself from others in terms of products and services. Thus, it is important for any player in a traditional industry (such as bank) to learn from leading organizations in other countries and develop differentiated practices and advantages. Fintech trends are one area where Canadian banks may develop a competitive advantage.

2. Better serve multicultural consumers by fully understanding their pre-immigration input

Through our own research here at Level5, we’ve learned that few organizations are actually aware of how their multicultural consumers previously banked in their native markets. Nor do they have a sense of what trends have driven growth in those markets. We’ve also discovered that the way these consumers used to bank can significantly impact the way they expect to be treated in Canada.

In examining the concept behind “from Fintech to Finlife”, as Cheng Li refers to it, one thing became clear to me. Chinese financial service providers have already gone beyond banking and are looking to address real-life scenarios. As such, customers coming from China are likely to have very different and higher expectations than other Canadians when seeking banking services.

At Level5, we leverage our experience and expertise spanning global regions and industries to uncover the market whitespace that drives growth opportunities for Canadian organizations. If you’d like to explore potential growth drivers for your organization, contact us to learn more.